Warriedar Resources (ASX:WA8) has achieved an antimony recovery of 83% from its Ricciardo deposit – the largest in its Golden Range project – with a saleable concentrate grade of 38.5% also yielded from metallurgical work.

The news – which at time of writing, is the most talked about on the HotCopper forums – shows a marketable antimony concentrate can be produced from the Western Australian project, with Warriedar looking ahead to consolidating Ricciardo with a maiden mineral resource estimate for antimony in the first quarter of 2025.

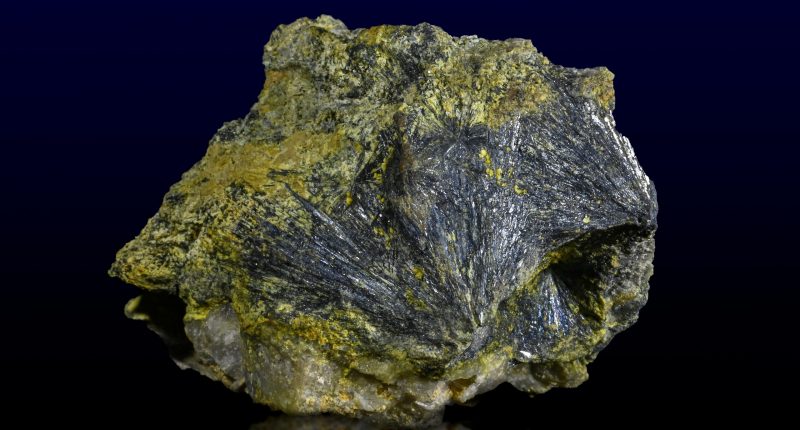

The company’s confidence in the mineral had begun earlier in the year, when diamond drilling showed intercepts such as 1.9 metres at 28.5% antimony (Sb) could be yielded from Ricciardo. This, plus a review of historical drill data, showed significant potential for antimony there.

The resulting metallurgical test work was built around diamond core from the 2024 program, which achieved an 83% recovery from single-stage closed-circuit flotation with grinding size 65% passing 75 microns (μm).

Warriedar managing director and CEO Amanda Buckingham said, “These initial met results for the primary antimony mineralisation at Ricciardo are undeniably exciting.”

“The context to them is the significant volume of antimony at Ricciardo, including high-grade zones that appear relatively discrete from the higher-grade gold mineralisation, that are not yet well-defined but show serious scale and grade potential.

“While we are excited about this emerging opportunity at Ricciardo, I want to emphasise again however that pursuit of this opportunity will be in parallel with our growth-focussed gold drilling at Golden Range, which remains our current core focus.”

Warriedar shares have moved up today, and at 13:26 AEDT, they were trading at 6 cents – a rise of 1.7% since the market opened.

Join the discussion: See what HotCopper users are saying about Warriedar and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.